- 1Orebody Risks Limited, Swansea, United Kingdom

- 2Allington Collaborative Problem Solving Ltd., Witney, United Kingdom

Modern society is heavily reliant on minerals to support current lifestyles and requires continued investment in the exploration, evaluation, development, and production of mineral raw materials. Potential investors and their advisors require reliable information to support decisions on investments in minerals projects. To address these needs, international guidelines and reporting standards have been developed. The Committee for Mineral Reserves International Reporting Standards (CRIRSCO) is an international association of fifteen regional organisations from around the world, which promotes best standards in international minerals reporting. The Pan-European Reserves and Resources Reporting Committee (PERC), the European member of CRIRSCO, is an association of six Europe-based professional organisations, including the Geological Society of London (GSL). CRIRSCO-aligned reporting standards, such as the PERC Reporting Standard, are based on common principles, rules and guidance, and include sixteen common definitions of key terms. A description of the CRIRSCO International Reporting Template, which provides the basis for the development and periodic updating of individual standards such as the PERC Reporting Standard, is provided. The different elements of the 2019 version of the CRIRSCO Template are described, together with a discussion of changes and additions made in the PERC Reporting Standard 2021 which is based on it. The need for continual development and enhancement of the CRIRSCO-aligned standards to address investor concerns such as the need for information on the environmental, social and governance (ESG) aspects of mineral projects, as well as greater rigour in defining competency requirements, is discussed. Reference is also made to the United Nations Framework Classification for Resources (UNFC) and its relationship with the CRIRSCO-aligned standards, including the proposed use of the UNFC in the European Union’s Critical Raw Materials Act (CRMA) and how the two systems could be used in a complementary manner to support the needs of both governments and investors in mineral companies.

Introduction

Our modern society is dependent on minerals-based raw materials to support construction, energy production and storage, transportation, communications and many other aspects of modern life (Minerals Education Coalition, 2021). Moving to a low-carbon economy, designed to reduce dependence on fossil fuels, will result in increased demand for other mineral raw materials which contain metals that are essential for new energy production and storage technologies (IEA, 2022; ETC, 2023).

For instance, the generation and use of renewable electricity will increase the demand for permanent magnet generators in wind turbines and permanent magnet motors in electric vehicles, many of which contain substantial amounts of the rare earth elements neodymium and praseodymium. Similarly, increasing the supply of solar and wind energy (both of which are subject to intermittent supply), together with increasing demand for electric vehicles, will result in increased demand for lithium, nickel, cobalt and other metals, collectively referred to as the “battery metals.”

The forecast increased demands for such metals, as highlighted in several recent reports (e.g., ETC, 2023; IRENA, 2023) will require investment in the expansion of production at existing mines and/or development of new projects. Such investment decisions (especially making a choice between different potential mineral investments) should be based on reliable information which uses consistent terminology and is prepared by competent professionals. Failure to do so may result in money being wasted on high-risk and/or speculative mining projects, with consequent damage to the reputation of the mining sector.

In this context, the availability of reliable and consistent information about actual and potential sources of supply of such minerals is of increasing importance to allow strategic planning by government and industry organisations. To avoid mis-allocation of funds due to speculation and the use of unreliable information, it is important that such information is reported in a clear and transparent manner using consistent terminology together with a discussions of any uncertainties and risks that could affect the project outturns. Historic incidents of “boom and bust” and deliberate fraud in the minerals sector led to the development of the Committee for Mineral Reserves International Reporting Standards (CRIRSCO), an international association of fifteen regional organisations from around the world, which was formed to develop and promote best practices in international minerals reporting. The Pan-European Reserves and Resources Reporting Committee (PERC), an association of six Europe-based professional organisations, is the European member of CRIRSCO.

The terminology and standards used for reporting on the exploration for and assessment of mineral deposits is continually evolving as highlighted in the overview of their development presented in this review. The CRIRSCO-aligned reporting codes and standards have been developed to protect investors by ensuring that the information presented to them by minerals companies is based on work done by suitably qualified and experienced professionals and explains the inherent risks and uncertainties related to minerals projects in a clear and transparent manner.

CRIRSCO’s International Reporting Template for the Public Reporting of Exploration Targets, Exploration Results, Mineral Resources and Mineral Reserves (the “CRIRSCO Template”) provides a framework for the development of national and regional reporting codes and standards and provides instructions and guidance on the different aspects which need to be taken into account when assessing and reporting on estimates of the size and mineral content of mineral deposits. The PERC Standard for Reporting of Exploration Results, Mineral Resources and Mineral Reserves (“The PERC Reporting Standard”) provides an example of a reporting standard which is based on, and aligned with, the CRIRSCO Template1.

An overview of mineral reporting codes and standards is presented below, followed by an introduction to the CRIRSCO Template and the PERC Reporting Standard. A discussion of several important aspects of these evolving reporting standards and their relevance in a European context is then provided.

Mineral Reporting Codes and Standards

Mineral reporting codes and standards were established and continue to be developed and improved to support consistent and reliable reporting of information on minerals projects. The discussion below covers codes and standards which are applicable to solid minerals only; a different system, the Petroleum Resource Management System (PRMS) maintained by the Society of Petroleum Engineers (SPE), is used for reporting on oil and gas projects in the petroleum sector (SPE, 2018).

Why Are They Needed?

Development and continued operation of mining projects requires input from several different parties, including, amongst others:

• Government bodies which are responsible for minerals and environmental permitting, tax, royalties and other aspects.

• Investors and their advisors who provide access to sources of finance such as debt and equity financing.

• Corporate managers who are responsible for decisions on development and operational strategies for exploration projects and mines.

• Local communities who may benefit from employment opportunities, or suffer adverse consequences if operations are not developed and operated in such a way as to minimise the impact on their surroundings.

Mineral reporting standards have been developed to support decision making by such parties by providing:

• Common terminology based on internationally agreed definitions so as to facilitate common understanding of information on mineral projects.

• Reliable information which is readily comparable with other similar projects elsewhere.

• A good understanding of the risks and uncertainties associated with a project and discussion of the steps that have been, or will be, taken to mitigate any adverse consequences and to maximise potential benefits.

• Information about development timelines and costs.

• Reassurance that the information provided to support decision making is based on the work of competent individuals who can be held accountable if things go wrong.

Reporting System Types

Some important steps in the evolution of mineral reporting codes and standards are summarised in Table 1 which highlights the fact that classification systems and related reporting codes and standards have been developed for different purposes. Such systems can be separated into two main categories, namely:

1) Systems designed for use by governments in strategic planning. These systems include: the Russian State Committee on Reserves (GKZ) system, the United States Bureau of Mines (USBM)/United States Geological Survey (USGS) system and the United Nations Framework Classification (UNFC).

2) Systems developed to support stock exchange disclosure by mineral companies. These systems are aimed at protecting investors from speculation and fraud, and include: the United States Securities and Exchange Commission’s (SEC’s) Industry Guide 7 (now superseded by regulation S-K 1300); the Australasian JORC Code (as incorporated in Appendix 5A of the ASX Listing Rules); the Canadian National Instrument 43–101 legislation, the PERC Reporting Standard and other CRIRSCO-aligned codes and standards.

A useful overview of the development of the CRIRSCO and UNFC systems, including a discussion of their complementary nature, is provided in Henley and Allington (2013). The discussion in this article is focused on the CRIRSCO-aligned codes and standards.

These international reporting standards are particularly important given the global nature of mining finance which most mineral companies need to access in order to fund the exploration and development of mining projects. Much of the exploration activity worldwide is driven by junior exploration companies that rely on equity finance from investors, a large proportion of which is obtained by listings on Canadian and Australian stock exchanges. Funding of the development of mineral projects, where larger companies are usually involved, is often based on a mix of equity and debt finance plus royalty and product stream revenue, with important sources of funding being the financial markets in London, Toronto and New York along with other financial centres.

Evolution of the Classification Terminology

Many hours have been spent, and doubtless will continue to be spent in the future, discussing the terminology used to describe natural rocks which have potential economic value, commonly referred to as “ore” when relating to metallic minerals. Such discussion commonly relates to the problem of explaining the uncertainties associated with the quantities and qualities of material which are estimated to be present in the sub-surface to investors.

A brief history of the early evolution of the terminology used in this context is given in Sides (2009), where it is noted that as early as 1902 the London-based Institution of Mining and Metallurgy (IMM) became the first professional organisation to require its members to use specific terminology in this regard (Kendall, 1901). The recommended term “ore in sight” did not remain in common usage for long, and was superceded by the introduction of the terms Proved Ore, Probable Ore and Prospective Ore, which were introduced in 1909 in the textbook “Principles of Mining” (Hoover, 1909) which was written by Herbert Hoover a mining engineer who worked on projects around the world before later switching to politics and going on to become President of the United States (Hoover, 1951).

Although there was some discussion about the terminology used for minerals reporting in the Transactions of the IMM during the 1950s, it was not until the early 1970s that events occurred that led to the development of the CRIRSCO reporting codes. The Poseidon bubble of 1969–1970, a speculative bubble associated with a junior nickel exploration company in Western Australian, resulted in a lot of investors losing money. This prompted the establishment in 1971 of the Joint Committee on Ore Reserves (JORC) which published its first report in 1972 (JORC, 1972). This, the first JORC report, noted that there was no consensus on the terminology to be used for reporting on ore reserves, and that it had been found that four different alternative sets of definitions were in common use by mining companies, namely: “Proved/Probable/Possible”; “Measured/Indicated/Inferred”; “Unclassified”; and “Traditional.” An updated version of the JORC Report, issued in 1981, recommended the preferred use of the “Proved/Probable/Possible” terminology only.

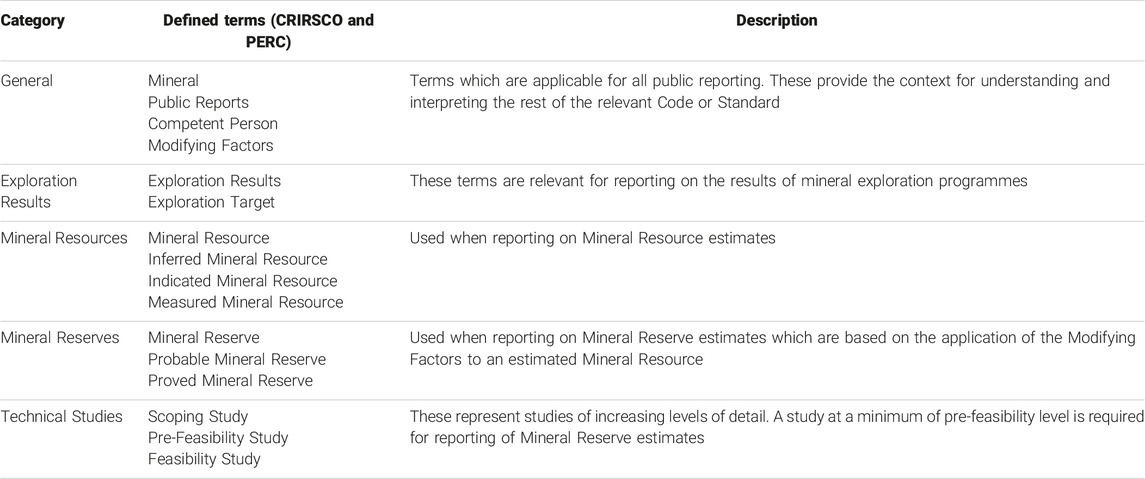

In the first official version of the JORC Code, published in 1989, the distinction between Mineral Resources and Ore Reserves was adopted, and the diagram showing the relationship between Mineral Resources as currently used in most of the CRIRSCO codes and standards (see Figure 1), was published.

Figure 1. Relationship between exploration results, mineral resources and mineral reserves (PERC, 2021).

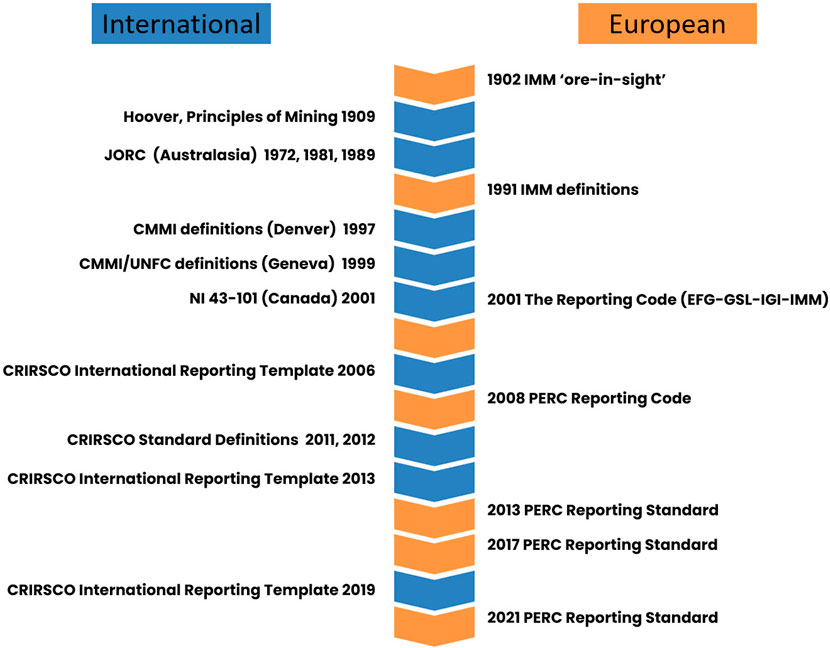

The impetus for international standardisation of definitions was provided at the 15th Council of Mining and Metallurgical Institutes (CMMI) Congress held at Sun City, South Africa in 1994, when a working group on reporting terminology was set up. Work completed by this “International Definitions group,” which subsequently evolved to become CRIRSCO, resulted in agreement on terminology for classifying Mineral Resources and Mineral Reserves and their respective sub-categories at a meeting held in Denver in 1997 (referred to as “The Denver Accord”). Following the formation of CRIRSCO in 2006, additional definitions to cover terms such as “Competent Person,” “Modifying Factors” and the different types of “Technical Studies,” were agreed. By 2012, fifteen CRIRSCO Standard Definitions had been agreed. In 2019, one additional defined term, “Mineral,” was added.

A summary of the PERC Standard Definitions, which are based on the definitions contained in the CRIRSCO International Reporting Template (CRIRSCO, 2019), is provided on the PERC website (PERC, 2021b).

Stock Market Regulation

An overview of some of the important aspects of the financial markets in relation to the minerals sector in Europe is provided in PERC (2022) which also explains some important terms used in this context. Due to some of the specific characteristics of mineral exploration and mining including the uncertainties inherent in estimating the quantities of minerals raw materials present in the sub-surface, and the long development time frames for many projects, minerals companies are recognised as specialist issuers by many regulators. In several countries this aspect is covered by government regulations on the trading of securities e.g., National Instrument 43–101—“Standards of Disclosure for Mineral Projects” (NI 43–101), in Canada (BCSC, 2023); and Regulation S-K subpart 1,300 (S-K 1300) covering the “Modernization of property disclosures for mining registrants” in the US (SEC, 2018) as well as by stock exchange listing rules, such as a separate section entitled “Additional reporting on mining and oil and gas production and exploration activities” in the Australian Securities Exchange (ASX)’s Listing Rules (ASX, 2013).

Such legislation and regulations make it mandatory for minerals companies to use agreed terminology and minimum reporting requirements such as those developed and maintained by the CRIRSCO member organisations. The main focus of such regulations is on the disclosure of information about mineral properties to investors, their advisors, and other potential investors. In this context, Segal (2020) notes that disclosure is defined as “the timely release of all information about a company that may influence an investor’s decision. It reveals both positive and negative news, data, and operational details that impact its business.” Segal notes that the underlying principle is that “all parties should have equal access to the same set of facts in the interest of fairness.”

The principle of disclosure has been evident in minerals reporting standards from the start. For instance, the IMM’s 1902 resolution specified that when reporting on an estimate of “ore in sight” Members of the Institution should indicate “in the most explicit manner, the data upon which the estimate is based.” Additionally there was a requirement that when using the term “ore in sight” an engineer should “demonstrate that the Ore so denominated is capable of being profitably extracted under the working conditions obtaining in the district.”

From the publication of the first JORC report in 1972 onwards, the development of the CRIRSCO reporting standards has focused on trying to standardise the reporting requirements. Rules are provided on the information that should be reported together with detailed guidance on matters which a Competent Person should consider when preparing information to support disclosure.

Another important aspect in this regard is the concept of materiality. For the purposes of financial auditing and accounting, information is considered to be material “if omitting, misstating or obscuring it could reasonably be expected to influence decisions that the primary users of general purpose financial statements make on the basis of those financial statements” (IFRS, 2021). In the context of minerals reporting, materiality is assessed with respect to the potential effect of an item on the reported estimates, as well as the significance of those estimates and their associated risks to a company’s overall business. The company making a disclosure, and the professional(s) advising it, must make a professional judgement as to whether or not they consider a particular aspect to be material or not.

CRIRSCO: The Committee For Mineral Reserves International Reporting Standards

Two high profile scandals affecting investors in the mining sector prompted a move towards the development of common terminology and minimum requirements for disclosure of information on minerals projects. Firstly, the Poseidon Bubble of 1969–1970 (a speculative bubble related to a nickel mining project in Australia) led to the formation of JORC and the subsequent development of the JORC Code. Secondly, the Bre-X fraud of 1997 (a major fraud related to a gold deposit in Indonesia being explored by a Canadian listed company) led to the development of the NI 43–101 legislation in Canada. These developments prompted increased co-operation between professional organisations of geologists and mining engineers around the world which led to the development of common terminology and agreed best practice for public reporting on minerals projects.

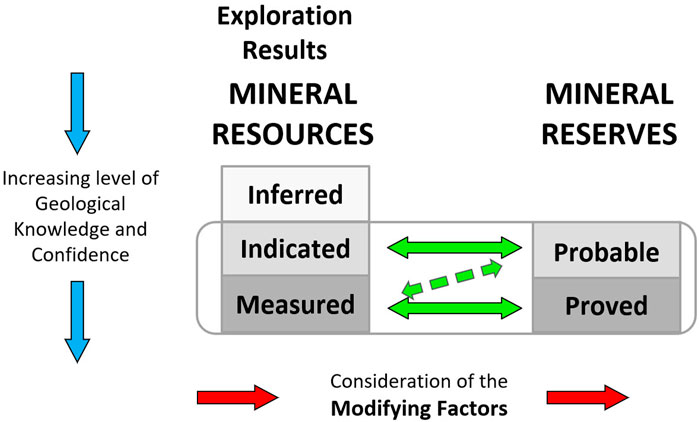

The acronym CRIRSCO arose with the formation of the Combined Reserves International Reporting Standards Committee at the CMMI Congress in Darwin in 2002. This Committee was the successor to the “International Definitions Group” formed by representatives of mining and metallurgical institutions from Australasia, Canada, South Africa, United Kingdom and United States at the CMMI Congress in South Africa in 1994. The full name of the committee was later changed but the acronym CRIRSCO has been retained. From 2007 onwards CRIRSCO received financial support from the International Council on Mining and Metals (ICMM) to support its work in promoting the adoption of common reporting standards around the world. In 2009, a Strategic Partnership between ICMM and CRIRSCO was established, and close cooperation has continued, helping to support CRIRSCO’s expansion from five to fifteen member organisations.

CRIRSCO is now recognised as the leading international body that deals with reporting standards for Mineral Resources and Mineral Reserves. The CRIRSCO member organisations are referred to as National Reporting Organisations (NROs) as indicated in Figure 2. The Pan-European Reserves and Resources Reporting Committee (PERC) is the NRO for Europe.

Figure 2. Equal area map of the world showing the CRIRSCO member organisations as at end November 2023.

To become a CRIRSCO NRO an organisation must meet the following criteria:

• Produce and be responsible for maintaining a Reporting Standard that is compatible with the CRIRSCO Template and which is either recognised as the standard for Public Reporting applicable in the country/region proposed, or the Reporting Standard that has the wide support of local or regional professional and regulatory bodies.

• Agree to conduct international consultation with the CRIRSCO member NROs before making amendments to its Reporting Standard.

• Include as appropriate in the NRO credible, self-regulating, professional organisations that have enforceable disciplinary systems and codes of ethics which govern the behaviour of Competent Persons (or equivalents) as defined in the Template, and have and maintain documented Continuing Professional Development (CPD) requirements.

• Commit to and engage actively in CRIRSCO activities.

• Commit to upholding and furthering the objectives of CRIRSCO.

CRIRSCO works at an international level to promote high standards of reporting, and to facilitate international consistency in Minerals Reporting. These objectives are achieved using two main approaches:

• Firstly, all the members of CRIRSCO have agreed to use the same definitions for the sixteen key terms.

• Secondly, CRIRSCO promotes consistency between the different reporting codes and standards used by the fifteen different national reporting organisations. This is done by means of the CRIRSCO Template (CRIRSCO, 2019) which is developed based on consensus between the CRIRSCO members. The CRIRSCO Template, which includes the CRIRSCO Standard Definitions, provides a basis on which individual national reporting codes can be created, and existing codes can be further developed

The CRIRSCO Template, and the national reporting standards aligned with it, are principles-based, and require adherence to the three key reporting principles of Transparency, Materiality and Competence, as discussed in more detail in Key elements of the CRIRSCO Template section.

PERC: The Pan-European Reserves and Resources Reporting Committee

The first reporting standard in Europe, referred to as the IMM Code, was produced by the IMM Reserves Committee in 1991. Subsequently, in 1999, a Working Group was established by the former Institution of Mining and Metallurgy (IMM) [now the Institute of Materials, Minerals and Mining (IOM3)]. In 2000, this group was expanded to include the European Federation of Geologists (EFG), the Geological Society of London (GSL) and the Institute of Geologists of Ireland (IGI). The expanded group developed “The (European) Reporting Code” which was published in 2001.

Following ongoing developments on the international front, PERC was established in 2006, and in 2008 the first version of the PERC Reporting Standard (actually referred to as a Code at that date) was released. From 2006 to 2013, PERC acted on an informal basis but in 2013 these arrangements were formalised, and PERC was legally registered in Belgium as an “association sans but lucratif” (ASBL–A not-for-profit association). In 2019, the membership of PERC increased with the admission of the Fennoscandian Association for Metals and Minerals Professionals (FAMMP) and the Iberian Mining Engineers Board (IMEB).

As a member organisation of CRIRSCO, PERC represents the interests of Europe based mining industry professionals, in particular the members of PERC’s six participating organisations, at an international level. One of its key activities is ongoing development and promotion of the PERC Reporting Standard.

As a requirement of membership of PERC, and PERC’s membership of CRIRSCO, all of the PERC participating organisations have the following features:

• A Code of Conduct/Code of Ethics;

• Enforceable disciplinary procedures (including powers to suspend or expel members); and

• CPD requirements and monitoring systems

These requirements underpin the Competent Person element of the CRIRSCO reporting codes and standards. Details about the structure, governance and activities of PERC are available on the organisation’s website2.

The CRIRSCO International Reporting Template

Origin and Purpose

The CRIRSCO Template is a document which provides an example of the use of the principles-based framework and the CRIRSCO Standard Definitions (CRIRSCO, 2019). It is used by the NROs when developing new reporting codes or reporting standards (or when updating existing ones). The PERC Reporting Standard provides an example of a CRIRSCO-aligned reporting standard.

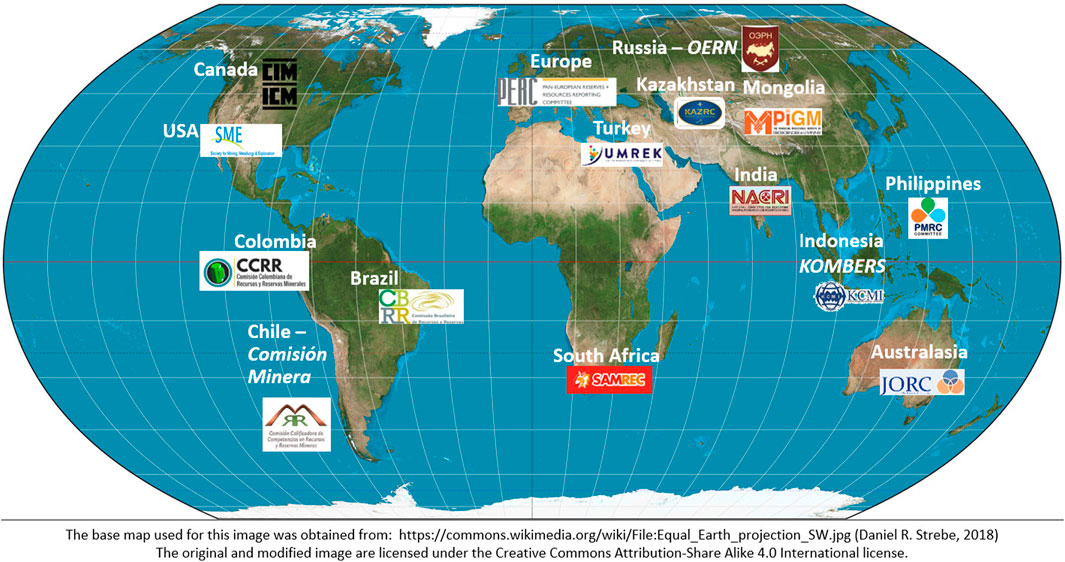

The CRIRSCO Template was first published in July 2006, and has since been updated in 2013 and 2019, as illustrated in Figure 3. The contents of the CRIRSCO Template are discussed in Key elements of the CRIRSCO Template section.

Figure 3. Timeline showing the evolution of International and European mineral reporting standards and definitions.

All of the elements of the CRIRSCO Template are used by the CRIRSCO NROs in their own national reporting standards, with modifications or additions to account for local reporting requirements. The PERC Reporting Standard, which was initially developed independently, has been consistent with the CRIRSCO Template from 2008 onwards.

The PERC Reporting Standard

The PERC Reporting Standard has been developed and maintained by PERC and is the CRIRSCO-aligned standard for the European region (including the countries of the EU and EEA plus the United Kingdom). As illustrated in Figure 3, The PERC Reporting Standard is the successor to the IMM definitions developed in 1991 and The [European] Reporting Code (EFG-GSL-IGI-IMM) which was issued in 2001. Since it was first published in 2008 (as the PERC Reporting Code) the PERC Reporting Standard has been regularly updated on a 4–5-year cycle, in order to maintain alignment with the CRIRSCO Template and to address issues of concern with respect to minerals reporting in Europe.

A useful overview of the PERC Reporting Standard, and its relevance to Mineral companies in Europe, is provided in the PERC Summary Guide (PERC, 2022). References to the contents of the PERC Reporting Standard in this article are based on the most recent version released in October 2021 (PERC, 2021a).

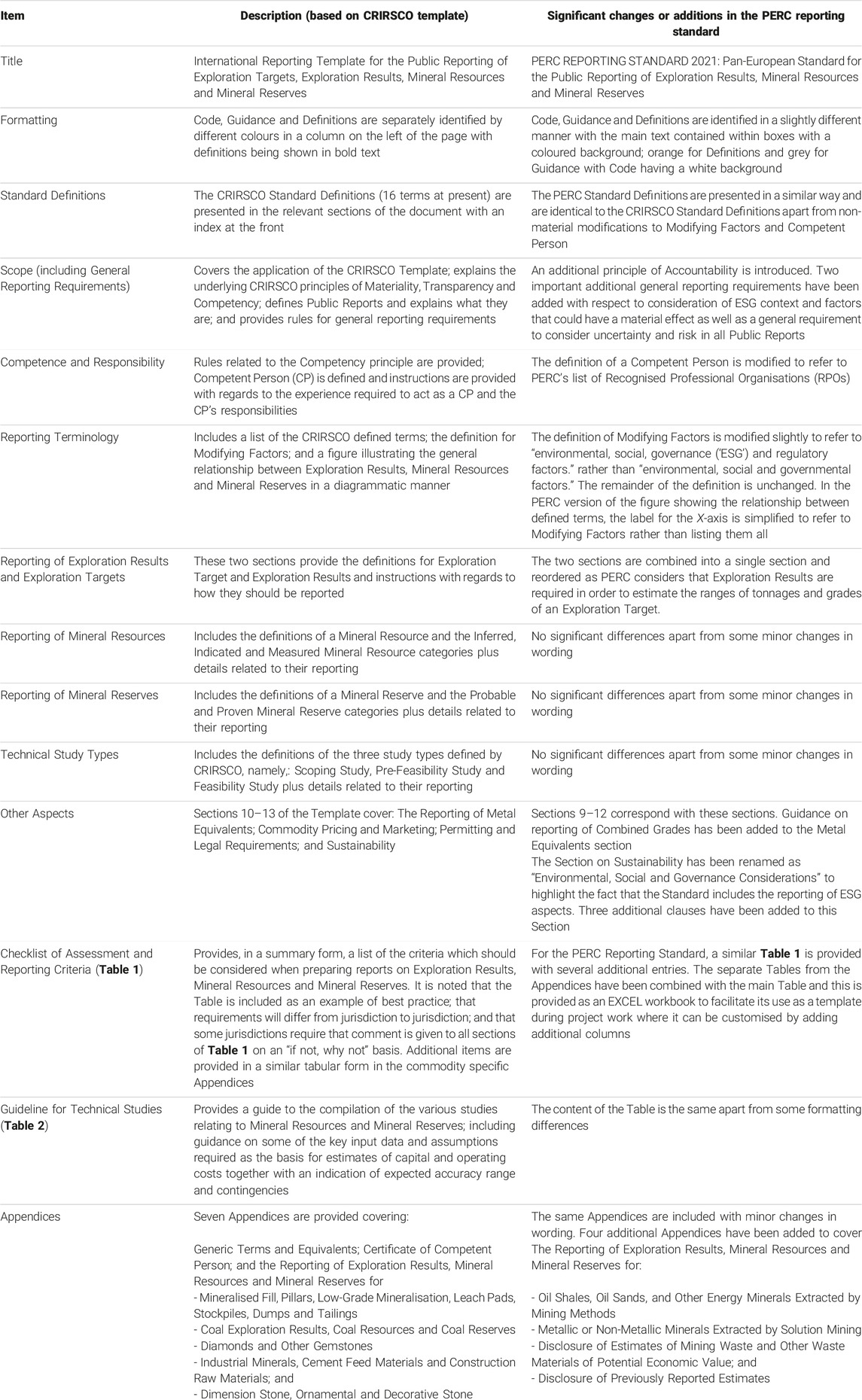

Key Elements of the CRIRSCO Template

Key elements of the CRIRSCO Template (CRIRSCO, 2019) are discussed briefly below together with comments on any significant modifications or additions introduced in the PERC Reporting Standard 2021 (PERC, 2021a). Table 4 provides a summary of the overall content of the CRIRSCO Template and a comparison against the PERC Reporting Standard to highlight where modifications and additions have been introduced.

It should be borne in mind that the CRIRSCO Template covers public reporting by minerals companies, where Public Reports are defined as “reports prepared for the purposes of informing investors or potential investors and their professional advisers on Exploration Results, Mineral Resources and of Mineral Reserves.” This is taken to include any information released into the public domain which someone might use as the basis for making an investment decision.

Title and Formatting

The full title of the CRIRSCO Template is “International Reporting Template for the public reporting of Exploration Targets, Exploration Results, Mineral Resources and Mineral Reserves.” It is organised into thirteen separate sections covering different topics and includes the agreed definitions of the sixteen key terms used in all of the CRIRSCO-aligned standards. The definitions and the mandatory “code” elements are presented as separate clauses numbered sequentially within each section, with colour coding in a reference column being used to distinguish between definitions, “code” and guidance.

In the PERC Reporting Standard, Exploration Targets are considered under the heading of Exploration Results with the term being removed from the title and two sub-sections of the CRIRSCO Template being combined. Additionally, different formatting is used in order to make it easier to distinguish between the definitions, “code” and guidance.

Reporting Terminology

A full list of the sixteen defined terms, as incorporated into the CRIRSCO Template is provided in Table 2. A summary of the definitions as used in the PERC Reporting Standard, is given in PERC (2021b). Figure 1, which has evolved from a figure originally presented in JORC (1989), shows the relationship between nine of the current CRIRSCO defined standard terms. The general usage of the defined terms, including the relationship between Mineral Resources and Mineral Reserves, is discussed in the Reporting Terminology Section of the CRIRSCO Template.

In line with one of the requirements of CRIRSCO membership, the definitions used in the PERC Reporting Standard 2021 do not differ in any material way from the definitions provided in the CRIRSCO Template (CRIRSCO, 2019). Some minor changes have been made in a few instances for consistency. For example, in the case of the definition of Modifying Factors, the phrase “environmental, social and governmental factors” has been changed to “environmental, social, governance (ESG) and regulatory factors” to make it clear that consideration of the Modifying Factors should include consideration of ESG aspects.

CRIRSCO Principles

The development and application of the CRIRSCO-aligned codes and standards for public reporting of Exploration Results, Mineral Resources and Mineral Reserves is based on three principles, namely:

1. Transparency, which requires that the reader of a Public Report is provided with sufficient information, the presentation of which is clear and unambiguous, so as to understand the report and not to be misled.

2. Materiality, which requires that a Public Report must contain all the relevant information which investors and their professional advisers would reasonably require, and reasonably expect to find in a Public Report, for the purpose of making a reasoned and balanced judgement regarding the Exploration Targets, Exploration Results, Mineral Resources and/or Mineral Reserves being reported.

3. Competence, which requires that the Public Report be based on work that is the responsibility of a suitably qualified and experienced person (referred to herein as a Competent Person) who is a member of a Professional Organisation (PO) with an enforceable code of ethics and disciplinary process, which includes the powers to suspend or expel a member.

Adherence to these principles is very important in jurisdictions where CRIRSCO definitions and requirements have been incorporated into government legislation and stock exchange regulations governing disclosure by publicly listed mineral companies. In a stock exchange context, disclosure means the act of releasing all relevant information on a company that may influence an investment decision. The concept of Material Information, defined as: “any information about a company or its products that is likely to change the perceived value of a security when it is disclosed to the public,” is particularly important in this context. The principle of transparency requires companies to present the information in Public Reports in a clear and understandable manner. It also implies that significant risks and uncertainties which may affect project outcomes should be discussed.

Competence and Responsibility

The definition of a Competent Person (CP) includes two separate elements, as illustrated below:

1. Qualification requirement: A Competent Person is a minerals industry professional, who is a [National Reporting Organisation (NRO) to insert appropriate membership class and name of Professional Organisation (PO)] or other Recognised Professional Organisations (RPOs) with enforceable disciplinary processes including the powers to suspend or expel a member.

2. Experience requirement: A Competent Person must have a minimum of 5 years relevant experience in the style of mineralisation or type of deposit under consideration and in the activity which that person is undertaking (CRIRSCO, 2019).

The CP assumes responsibility for the information included in a CRIRSCO-aligned Public Report and is identified as the person who provided the information on which the report is based, with their name and qualifications being provided in the report. Thus the CP must be prepared to be held accountable if it is subsequently found that they provided false or misleading information or failed to disclose known uncertainties and risks which had a material effect on the reported estimates and forecast project outcomes.

To be recognised as suitable for awarding acceptable qualifications, the professional organisations associated with the CRIRSCO NROs are required to demonstrate that they have processes in place to ensure that members who can act as Competent Persons have appropriate qualifications and are obliged to adhere to an enforceable code of conduct and/or code of ethics.

Recognised Professional Organisations (RPOs), provide the mechanism by which individual members of one of the region’s professional bodies are recognised as having the necessary qualifications to act as Competent Persons in another region. For the purposes of acting as a CP with respect to the PERC Reporting Standard, PERC publishes a list of RPOs–which is updated periodically–on the PERC website.

Reporting of Exploration Results and Exploration Targets

Exploration Results are considered to include data and information generated by mineral exploration programmes that may be of interest to investors, but which are considered to be insufficient to allow reasonable estimates of tonnages and grade or quality to be made.

The only situation in which tonnage and grade estimates can be reported in connection with Exploration Results is when reporting an Exploration Target. This is defined as a statement or estimate of the exploration potential of a mineral deposit in a defined geological setting and must be quoted as a range of tonnes and a range of grade or quality values. When reporting on an Exploration Target, care needs to be taken to ensure that such estimates cannot be confused with estimates of Mineral Resources or Mineral Reserves and it must be clearly stated that it is uncertain whether further exploration will lead to the determination of a Mineral Resource.

In the CRIRSCO Template the topics of Exploration Results and Exploration Targets are covered in two separate sections, whereas in the PERC Reporting Standard they are combined in a single section. PERC considers that some initial Exploration Results are needed in order to be able to estimate the ranges of quantities and grade for an Exploration Target.

Reporting of Mineral Resources

A key part of the definition of a Mineral Resource is that it represents material for which “there are reasonable prospects for eventual economic extraction (RPEEE).” This requires preliminary consideration of the Modifying Factors, which are applied when converting a Mineral Resource to a Mineral Reserve, even at the earlier stage of preparing a Mineral Resource estimate. For instance, material which is in a location where mining might not be technically feasible or might not be permitted, should be excluded from a Mineral Resource estimate.

Assessment of whether there are RPEEE requires a CP to take into account factors such as the quality, extent and continuity of mineralisation. In the case of stratiform mineralisation, which is to be mined using underground mining methods, this might result in the exclusion of mineralised material which does not meet some minimum thickness threshold from the reported Mineral Resource. Likewise, reported Mineral Resources for proposed open-pit projects are normally constrained within a technically and economically feasible pit-shell to ensure that isolated blocks of mineralisation and deeper mineralisation which could only be extracted with a very high waste:ore ratio, are excluded.

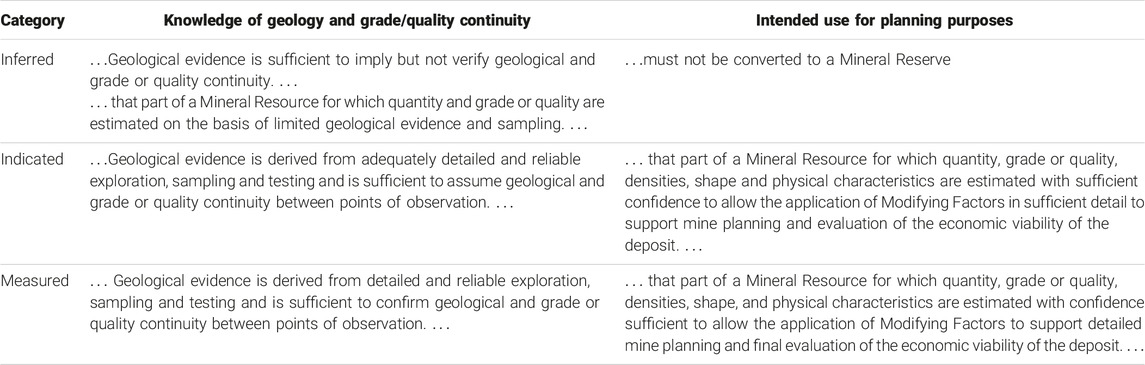

It is the responsibility of the CP to classify a Mineral Resource estimate into the three confidence categories. Table 3, which contains extracts from the respective definitions of each category, illustrates how this requires consideration of both the knowledge about geological and grade continuity, and also the level of planning detail which the estimate will be used to support. As a rule of thumb, Measured Mineral Resources should only be reported when the CP is confident that no significant additional sampling and analysis work (apart from grade control measures which form part of the extraction plan) will be required prior to commencing extraction of the Measured Mineral Resources.

Table 3. Key criteria used as the basis for classifying a Mineral Resource estimate into the three different confidence categories.

Technical Studies and the Reporting of Mineral Reserves

Mineral Reserves represent the economically mineable part of Measured Mineral Resources and/or Indicated Mineral Resources. They are based on the application of the Modifying Factors to a Mineral Resource estimate, and this requires technical studies at a minimum of pre-Feasibility level to be carried out in order to support the conclusion that, at the time of reporting, extraction can reasonably be justified. Such studies need to include an assessment of all relevant capital and operating costs, combined with a detailed extraction schedule for the life of mine and an accompanying financial analysis in order to confirm that the material included in the Mineral Reserves is economically mineable. For established operations, a recent history of successful production could also be used to support reporting of Mineral Reserves provided there have been no material changes to aspects such as permits, market prices, etc.

Confidence categories also need to be assigned to Mineral Reserve estimates by a CP. As shown in Figure 1, Indicated Mineral Resources are generally converted to Probable Mineral Reserves, and Measured Mineral Resources to Proved Mineral Reserves. There are, however, situations in which uncertainties about the Modifying Factors result in Measured Mineral Resources being converted to the lower confidence Probable Mineral Reserves.

A scoping level study, sometimes referred to as a preliminary economic assessment (PEA), is typically carried out as soon as adequate Mineral Resources have been defined to support a potential mining operation. At this stage a preliminary assessment is carried out of technical aspects related to mining, processing, and infrastructure development as well as environmental and social baseline studies. The results of a Scoping Study provide an indication of the likely magnitude of Mineral Reserves for the deposit and allow the definition of the work necessary to assess the project at a pre-Feasibility level. Public Reporting of the results of a Scoping Study would typically be used to support the raising of finance to advance the project to pre-Feasibility Study level.

Other Aspects

Additional aspects covered in the CRIRSCO Template include consideration of:

1. Reporting of Metal equivalents: in such instances the individual grade values and other parameters used to derive the reported metal equivalent grades must be clearly explained. The PERC Reporting Standard recommends that a similar approach should be used for combined metal grades such as total rare earth element (TREE) content where the prices of the individual rare earth elements may vary by several orders of magnitude.

2. Commodity pricing and marketing: the basis used for future commodity price forecasts and assumptions about market access must be clearly indicated when reporting on Mineral Resources and Mineral Reserves.

3. Permitting and legal aspects: obtaining the necessary licences and permits is essential before mining can be commenced and/or be continued. Prior to the declaration of Mineral Reserves, a CP should be satisfied that there are no known material aspects relevant to mining, arising from the failure to obtain, or retain, the necessary permits.

4. Sustainability considerations: at all stages of mine project development, Public Reports should discuss any ESG aspects of a project which could affect its development, operation or be relevant to planning for eventual closure and rehabilitation.

For several of the aspects noted above it may be necessary for a CP to seek advice from other experts, for instance the status of licences and permits may need to be confirmed by a legal expert; the anticipated prices for specialist commodities such as gemstones, industrial minerals and dimension stone may require input from specialists in a particular market. Likewise, consideration of ESG aspects is likely to require input from environmental and social scientists who are experienced in dealing with minerals projects.

Other Elements

Important additional information is included in two Tables and seven Appendices that form part of the CRIRSCO Template. As indicated in Table 4, some additional Appendices have been included in the PERC Reporting Standard in order to address some specific commodities and situations of relevance to the European minerals industry.

Table 4. Summary of the contents of the CRIRSCO Template (CRIRSCO, 2019) and comparison against the PERC Reporting Standard (PERC, 2021a).

It should be noted that the appendices in the CRIRSCO Template which relate to industrial minerals and dimension stone were originally introduced in the PERC Reporting Standard, to address some of the specific needs of the European extractives industry, prior to being incorporated into the CRIRSCO Template. This illustrates the way in which changes introduced in the PERC Reporting Standard can have an effect on international reporting practices whereby they are subsequently incorporated into the CRIRSCO Template; such changes are likely to be later incorporated into updated or new versions of codes or standards developed by other CRIRSCO reporting organisations.

PERC Reporting Standard Additions

In the PERC Reporting Standard, the following important additions have been made with respect to the CRIRSCO Template:

1. The principle of Accountability: Accountability requires that the CP(s) named in a Public Report must accept responsibility for the information and supporting documentation which they have provided. This principle has been added to make clear that by acting as a CP the person is accepting responsibility for the work on which the Public Report is based. This is evidenced by the signing of a CP’s consent form, so that they can be held accountable should issues arise where Public Reports are subsequently found to be misleading or inaccurate.

2. Reporting of ESG aspects: In order to make clear that ESG aspects need to be considered during the preparation of all Public Reports, the following general reporting requirement has been added: All Public Reports of Exploration Results, Mineral Resources and Mineral Reserves must include the consideration and reporting of the environmental, social performance (including health and safety), and governance (ESG) context and factors that could have a material effect on the outcome of the project or operation (Clause 2.31, PERC, 2021a).

3. Risks and Uncertainties: A further general requirement to consider and discuss risks and uncertainties when preparing all Public Reports has also been added (Clauses 2.32 to 2.36, PERC, 2021a). The term risk, as used in The PERC Reporting Standard, is defined as “the effect of uncertainty on objectives,” and as such is considered to include both opportunities and threats. Typically, opportunities are of more interest to investors at earlier stages in project development, whereas threats tend to be the principal focus during the construction and operation phases.

Discussion

Reporting Terminology

CRIRSCO was originally formed as the result of discussions between organisations representing mining professionals from several different countries on the need to standardise the terminology used for describing estimates of “ore reserves” internationally to provide a common basis for investors and their advisors for comparing mineral projects owned by different companies in different countries. The adoption of the CRIRSCO standard definitions by its fifteen member organisations forms a critical part of the international system of CRIRSCO-aligned codes and standards. These definitions are subject to ongoing review and updating in order to further clarify specific aspects and to address the evolving concerns of investors.

Professional Competence

Concerns about professional competence have been an issue since the early discussions on minerals reporting by mining professionals (IMM, 1901). In the IMM’s 1902 resolution, members of the IMM were advised to avoid any “ambiguity or mystery” with respect to the use of the term “ore in sight” in reports, since such ambiguity was regarded as “an indication of dishonesty or incompetence” (IMM, 1902, as reproduced in Sides, 2009).

The importance of competence was stressed in the first report of the JORC committee published in the aftermath of the Poseidon bubble (JORC, 1972). In its recommendations, the Committee noted that it “considers that competence and experience are the most important factors involved in reporting on an ore or mineralization situation,” and that it was not unreasonable to ask any company “exploring for minerals to meet a required level of competence, as a condition of listing with the Stock Exchanges.” JORC proposed the definition of three related terms in this regard, namely,: “Competent Person,” “Competent Company” and “Competent Report.” The suggested definition of a Competent Person was: “Where reports on a company’s ore or mineralization situation are concerned, a person responsible for the compilation of such reports would be acceptable as “competent” if he is a Corporate Member of The Australasian Institute of Mining and Metallurgy, and also has a minimum of 5 years’ experience in the field of activity in which he is reporting.” This early recommendation by JORC has formed the basis for subsequent development of the CRIRSCO family of reporting codes, and the concept of the Competent Person (also Qualified Person as used in Canada) remains one of the essential elements of the CRIRSCO reporting standards. For instance, in addition to having an approved professional qualification, the PERC Reporting Standard requires PERC CPs to “have a minimum of 5 years’ relevant experience in the style of mineralisation or type of Mineral deposit under consideration and in the activity which that person is undertaking.”

The results of a detailed study of competency in the context of reporting under the JORC Code is described in Coombes (2013). The study took account of theories on social structures, workplace learning theories and statistical reasoning education theories in order to develop a competency development model for JORC CPs. In broad terms this suggested the following evolution of competency during an individual’s professional career.

- Several years of study to gain academic qualification in a relevant subject. In some cases a longer period of working in a non-academic “apprenticeship” role may suffice;

- Sufficient years in training to understand the basic terminologies and standard practices and how and why they are used;

- Sufficient experience of applying such procedures under supervision, in a selected area of expertise and on specific deposit type(s) and commodity(ies);

- The ability to apply such procedures independently in the specific area of expertise

- Ongoing personal CPD in order to keep up to date with changes in technology, industry practices and regulations and be able to adapt to new circumstances

As discussed in Fernández-Fuentes et al. (2021), the requirements for recognising competency in the geosciences varies from country to country within Europe. Likewise, the processes used by the different CRIRSCO NROs for accepting a professional as fulfilling the necessary criteria to act as a CP vary from region to region. With regards to the experience requirement, this is generally based on “self-certification” whereby the individual involved agrees to act as a CP on the basis that they “are satisfied in their own minds that they could face their peers and demonstrate competence in the commodity, type of deposit and situation under consideration.” In some jurisdictions such as Brazil, Chile and Colombia an official register of Competent Persons and their areas of experience is maintained.

The concept of “self-certification” is rather subjective. For instance, Coombes (2013) reported on the results of a statistical comparison of self-assessment scores by a sample of sixty five resource geologists, most of whom were JORC CPs, against a more objective measure of JORC reasoning ability. Based on the results of this study, Coombes concluded that: “Resource geologists tend not to be able to accurately self-assess their competency”.

Coombes also noted the benefits of CPs having a broad knowledge of the mining sector from exploration through to production, as well as experience in a range of different commodities, in order to be better able to identify key uncertainties for a particular project. In general, there has perhaps been an over-emphasis in the CRIRSCO-aligned standards on competencies related to geological interpretation, exploration data collection and resource estimation methods, with less attention paid to financial modelling and the assessment of environmental, social and economic aspects which are used to determine a project’s viability. For instance, in a review of technical studies for three tungsten projects located in Europe, Krzemień et al. (2016) concluded that there was a lack of standardisation and some specific deficiencies in the reporting of the financial models for the projects which were used to generate some of the key financial metrics for the project. In addition, the increasing need to consider ESG aspects means that it is often necessary for a CP to seek input from specialists, other than geologists and mining engineers, who may not meet the requirements to act as a CP.

In relation to a planned update of the JORC Code, the Australian Securities and Investments Commission (ASIC) raised concerns about competency with JORC. As a result JORC’s two parent organisations, the Australasian Institute of Mining and Metallurgy (AusIMM) and the Australian Institute of Geoscientists (AIG), commissioned a baseline review of how competency was being handled around the world, the results of which were reported in Waltho et al. (2022). This report mentions three specific concerns related to competency which had been raised by ASIC, namely,:

• “Limited oversight and self-assessed competency for practitioners results in reports and statements prepared in accordance with the Code being of varying quality and in some cases being unreliable and incomparable.”

• With respect to a number of high-profile mining project development failures “… several instances where the root cause of investor loss has been the competence of the practitioners preparing information in accordance with the [JORC] Code.”

• The existing Complaints and Ethics processes are not effective and that “enforcement is impractical in all but extreme cases.”

It is anticipated that the next update of the JORC Code, which is currently being finalised, will include additional instructions and guidance on Competent Persons. In addition, the results of the review completed by Waltho et al. (2022) are still being assessed by JORC’s parent organisations and may result in changes to the requirements that need to be met to act as a JORC CP.

Reporting of Environmental, Social and Governance Aspects

There is an important link between consideration of ESG aspects of mining projects and international initiatives on sustainable development. The Brundtland Commission’s landmark report, published in 1987, defined sustainability as “[meeting] the needs of the present without compromising the ability of future generations to meet their own needs” (Brundtland, 1987). This report formed the impetus for further international cooperation on sustainable development, leading to the publication of the Millennium Development Goals (MDGs) in 2000 (United Nations, 2000) and the Sustainable Development Goals (SDGs) in 2015 (United Nations, 2015).

As discussed by Sides (2021), the recent focus by the finance and investment community on the reporting of ESG aspects to investors can be traced back to the launch of the UN’s Principles of Responsible Investment (PRI), at an event held at the New York Stock Exchange in April 2006. At that event, the UN Secretary General Kofi Annan stated that: “while finance fuels the global economy, investment decision-making does not sufficiently reflect environmental, social and corporate governance considerations–– or put another way, the tenets of sustainable development.” The PRI are a voluntary and aspirational set of investment principles that offer several options for incorporating ESG issues into investment practice (UNPRI, 2021). At the time of the launch of the Principles, an independent body called the PRI (see3), which is supported by but not part of the United Nations, was set up to promote their adoption by investors. Since the PRI were launched in 2006, they have attracted a global signatory base which now represents the majority of the world’s professionally managed investments, with over 3,000 different signatories, and this has resulted in an increased focus by investors and their advisors on the ESG aspects of company activities and investment funds.

The development of mineral resources plays an important role in economic development in many countries but can also give rise to adverse environmental and social problems. In recognition of this, in 2003 the International Council on Mining and Metals (ICMM), a mining industry body, published its 10 Principles for sustainable development to set a standard of ethical performance for its members, and these have been periodically reviewed and updated since then (ICMM, 2022). As a consequence, consideration of sustainable development may affect the assumptions used as the basis for publicly reported Mineral Resources and Mineral Reserves.

The need to provide specific guidance on the reporting on ESG aspects in a mining context was first recognised by the South African SAMCODES Standards Committee (SSC), with the publication in 2016 of the South African guideline for the reporting of environmental, social and governance parameters within the solid minerals, oil and gas industries (the SAMESG guideline). The intention of the SAMESG Guideline is to define the key ESG aspects which influence the assessment of RPEEE as well as the Modifying Factors (SAMESG, 2017).

At the CRIRSCO AGM held in September 2020, it was agreed that, although the CRIRSCO Template already included a requirement to consider ESG aspects when applying the Modifying Factors, insufficient attention was being paid to this requirement. PERC was asked to take this issue into consideration during the update of the PERC reporting Standard.

As a result of this initiative, reporting of ESG aspects has been given more prominence in the PERC Reporting Standard 2021, including renaming of the title of Section 12 from Sustainability Considerations to Environmental, Social and Governance Considerations (PERC, 2021a). The definition of Modifying Factors was modified slightly to make clearer the fact that these include consideration of ESG aspects. Indication is also given in the main body of the PERC Reporting Standard of the need to consider ESG aspects from the Exploration Stage of a project onwards.

More recently, the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) has published ESG guidelines for Mineral Resource and Mineral Reserve estimation (CIM, 2023). JORC has also announced that the next update of the JORC Code will include additional clauses and guidance related to reporting of ESG aspects.

The United Nations Framework Classification–A Complementary Classification System

In the 1990s the United Nations Economic Commission for Europe (UNECE) was tasked with developing a simple, user-friendly and uniform system for classifying and reporting reserves and resources of solid fuels and mineral commodities. This resulted in the development of United Nations Framework Classification for Reserves and Resources of Solid Fuels and Mineral Commodities (UNFC-1997) which was endorsed by the United Nations Economic and Social Council (ECOSOC) in 1997 (UNECE, 1997). Since then, the scope of the UNFC was broadened in 2004 to include petroleum (oil and natural gas) and uranium, and in 2009 to include renewable energy, injection projects for geological storage and anthropogenic resources. The most recent version, referred to as the United Nations Framework Classification for Resources was adopted in 2019 (UNECE, 2019).

One of the main differences between the UNFC and the CRIRSCO reporting standards is the use of a three-axis framework for classification, based on separate consideration of:

1. The degree of Economic viability (E-axis).

2. The stage of Feasibility assessment (F-axis).

3. The stage of Geological assessment (G-axis).

To facilitate the UNECE’s requirement to develop an international standard which would be accessible to speakers of different languages other than English, the UNFC uses a numeric coding with three numeric digits, representing values corresponding to the E-F-G axes. Low numbers indicate greater confidence or more detailed study, such that 111 indicates a quantity that has the highest degree of economic viability and the highest degree of assurance with respect to geologic and feasibility assessment.

Initially, the UNFC and the CRIRSCO standards were not that dissimilar, and indeed the early versions of the terms Mineral Resource and Mineral Reserve, as developed by the CMMI working group, were incorporated into the English language version of the 1997 version (UNECE, 1997). However, with the expansion of the UNFC to include a wider range of sectors, the use of minerals sector specific terminology was no longer appropriate and these definitions were removed from the UNFC after 2004. To facilitate the use of different systems in different sectors, the UNECE has developed a series of “bridging documents” including the CRIRSCO-UNFC bridging document (UNECE, 2015) which includes instructions and guidelines on how to classify estimates reported under CRIRSCO-aligned codes and standards using the UNFC-2009 numerical codes. In addition, the UNECE publishes additional guidance on the application of the UNFC in different sectors, including the “Supplementary Specifications for the Application of the United Nations Framework Classification for Resources to Minerals” (UNECE, 2021).

Henley and Allington (2013) provide an overview of the history of the CRIRSCO and UNFC systems including a discussions of some of the main differences between the two systems. They note that the UNFC has been developed primarily to provide a framework for the standardization of mineral deposit estimates for regulatory and statistical purposes. As such, the UNFC is best suited for use in strategic planning by government and intergovernmental organisations, or large companies, where a portfolio of projects at different stages of development have to be taken into consideration. By contrast, the CRIRSCO reporting standards are mainly focused on disclosure of information on specific projects at important stages in their development when investment is being sought to proceed with the next stage of work on a particular project. One key difference is that under the CRIRSCO-aligned systems, public reporting of estimates of sub-economic mineralisation is prohibited in order to avoid potentially misleading investors.

At the time of writing a joint CRIRSCO- UNECE task group is finalising an updated version of the CRIRSCO-UNFC bridging document to align it with the most recent versions of both systems, and it is anticipated that this will be released in the first half of 2024. The CRIRSCO-UNFC bridging document provides a mapping between the CRIRSCO defined terms and the UNFC numeric codes, making it easy to incorporate estimates that are publicly reported in compliance with one of the CRIRSCO aligned standards into a UNFC compilation of a portfolio of projects at national or international level. Transfer of estimates originally reported using the UNFC classification to a CRIRSCO standard is not as straightforward, since this would require the work to comply with all of the reporting requirements in the relevant CRIRSCO Standard, in compliance with the CRIRSCO principles and Competent Person requirements.

The European Union’s Critical Raw Materials Act

In March 2023, the European Commission published the Critical Raw Materials Act (CRMA) which sets targets for improving the refining, processing and recycling of critical raw materials in Europe in order to increase the resilience of the supply chains on which European industry depends. The CRMA has moved rapidly through the EU’s approval processes, with agreement being reached between the European Parliament and the European Commission on the proposed text in September 2023 (European Commission, 2023). At the time of writing, discussions about the finalisation and implementation of the CRMA are being held with the Member States and it is anticipated that it will come into effect during 2024.

The CRMA defines two categories of raw materials, namely, Critical Raw Materials (CRMs) and Strategic Raw Materials (SRMs), the latter being ones where there are concerns about over-reliance on a limited number of sources of supply for materials that are essential for European industry. The CRMA envisages the provision of a mechanism for promoters of projects related to SRMs to be recognised as Strategic Projects the development of which would be assisted by stream-lined permitting procedures and assistance with gaining access to finance. In addition, the CRMA includes requirements for the Member States to maintain databases of CRM projects on their national territories and to provide information about these to the European Commission in a standard format including, where appropriate, UNFC classifications for such projects.

The CRMA includes a requirement for the use of the UNFC for the reporting of information related to sources of minerals supply in order to assist in the following objectives:

1. Maintenance of national and transnational mineral information databases: where the UNFC provides a framework to harmonise information obtained from different sources. In this context, the sub-division of estimates for individual deposits into confidence categories is important for the assessment of the overall level of confidence in aggregated resource and reserve totals.

2. Project Assessment and Monitoring: where the UNFC provides a framework to compare raw materials projects across the spectrum from exploration to extraction, processing, and recycling. Significant emphasis is placed on the overall socio-environmental acceptability of the project as well as its stage of technical development

The development and release of the CRMA has stimulated greater interest in the European minerals sector. In this context PERC has a role to play in raising awareness about international minerals reporting procedure, as well as informing policymakers in more detail about the procedures involved in exploration for and development of mineral projects, particularly for projects located in Europe.

Conclusion

Minerals reporting standards play an essential role in providing protection to investors in the mining sector. The development of the CRIRSCO-aligned codes and standards has allowed the adoption of common terminology for reporting on most of the stock exchanges around the world where mining and mineral exploration companies are listed. Organisations such as CRIRSCO, and its European member organisation PERC, are helping to promote good practice in minerals reporting. These organisations also provide a forum for sharing good practice and for continued development of the reporting standards to address issues of concern.

Although the PERC Reporting Standard has not been formally adopted as part of any regulatory code or legislation, it is still important for United Kingdom and mainland Europe based companies and minerals industry professionals to be aware of it and to use it where appropriate.

For minerals companies, the benefits of using the PERC Reporting Standard include:

• It helps a company to demonstrate to its shareholders and government regulators that it is following best industry practice.

• For companies listed on exchanges with no specific disclosure requirements for minerals companies, the use of a reporting standard such as PERC when preparing public reports will help to avoid issues with stock exchange regulators and may also increase the attractiveness of a company to potential investors.

• Several unlisted, private, companies use the PERC Reporting Standard to confirm to their investors and other stakeholders that they are using internationally recognised good practice approaches.

For Europe based mining professionals, the benefits of using the PERC Reporting Standard include:

• For professionals who belong to one of PERC’s member organisations such as the GSL, their organisation’s code of conduct or ethics may include a requirement to apply the definitions and principles of the PERC Reporting Standard when providing information to minerals companies for the purposes of public reporting.

• Even in situations where one’s employer or a client requires the use of another reporting code such as the JORC Code, professionals should be aware that all the reporting standards specify that they “provide minimum standards, recommendations and guidelines.” Hence, if more detailed, or more up to date, guidance is provided in the PERC Reporting Standard this should be taken into account.

In recent years there has been an increased focus by the United Kingdom government and the European Commission (EC) on the extractives sector in Europe. Concerns about the security of supply of mineral raw materials to support European industry led the EC to publish a list of CRMs upon which European manufacturers are particularly dependent. A list of fourteen CRMs which was first published in 2011, has been updated several times, with the most recent list of thirty four CRMs being included in the CRMA (European Commission, 2023). All of the CRMs in the most recently published list are derived from mined rocks or minerals.

As part of its Action Plan on CRMs, the EC seeks to “Identify mining and processing projects and investment needs and related financing opportunities for critical raw materials in the EU that can be operational by 2025” (European Commission, 2020). Given that discovery, evaluation, and development of a new mining project typically has a time frame greater than 5 years, it is highly likely that primary sources of CRMs with near-term development potential will already have Mineral Resources and Mineral Reserves reported in compliance with one of the CRIRSCO-aligned codes and standards. Screening and comparison of potential investment opportunities would be greatly facilitated by a requirement for applications to be supported by a Competent Person’s Report based on one of the CRIRSCO Standards, ideally the PERC Reporting Standard for mineral projects located in Europe. Such an approach would reduce the risk that investments may be wrongly directed at speculative or sub-economic projects.

Information obtained from CRIRSCO-aligned reports can be readily incorporated into mineral inventory databases based on the UNFC using the CRIRSCO-UNFC bridging document for guidance on assigning the necessary UNFC codes. In this way, the two systems which were originally designed for different purposes can be used in a complementary manner to provide a basis for mineral inventory databases to support government strategic planning as well as providing guidelines for the public reporting of mineral deposit estimates for use by investors in minerals companies and mineral projects.

Developments such as the introduction of the CRMA, as part of the response to supply chain disruptions caused by the Covid-19 pandemic and the war in Ukraine, highlight the need for continual review and updating of the mineral reporting standards. Both the CRIRSCO Template and the PERC Reporting Standard have been regularly updated at 4–7 years intervals since they were originally published. Further updates will be required in order to address aspects related to the supply of critical raw materials, the energy transition, circular economy and achieving the SDGs. For instance, life cycle assessment may require the tracking of mineral raw materials from their original source through to the products which they are used in, as well as reporting of both waste and product streams in mineral operations. Changes to the reporting codes and standards may also be required in order to address the need to report minor metal contents, which are often only determined at a low level of accuracy, at the resource and reserve estimation stage. For instance, several of the critical raw materials identified by the EU, such as gallium, germanium and scandium, are not normally estimated at the resource estimation stage since they are recovered as byproducts at later processing stages during metal refining.

Author Contributions

ES is the principal author, RA has contributed to the materials and presentation on which the article is based. RA has reviewed the full article. All authors contributed to the article and approved the submitted version.

Conflict of Interest

Author ES was a director of the company Orebody Risks Limited. Author RA was a director of the company Allington Collaborative Problem Solving Ltd.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1The term CRIRSCO-aligned is used to indicate a code or standard which is aligned with the CRIRSCO Template.

References

ASX (2013). Australian Securities Exchange (ASX) Listing Rules, Appendix 5A. Available at: https://www2.asx.com.au/content/dam/asx/rules-guidance-notes-waivers/asx-listing-rules/appendices/Appendix_05A.pdf (Accessed December 14, 2023).

BCSC (2023). British Columbia Securities Commission (BCSC) Guidance for Reporting by Mining Issuers in Canada. Available at: https://www.bcsc.bc.ca/industry/issuer-regulation/guidance-by-sector/mining (Accessed December 17, 2023).

Brundtland, G. (1987). Report of the World Commission on Environment and Development: Our Common Future. United Nations General Assembly Document A/42/427, 300pp. Available at: https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf (Accessed December 14, 2023).

CIM (2023). CIM Environmental, Social and Governance Guidelines for Mineral Resource and Mineral Reserve Estimation. 64pp. Prepared by the CIM Environmental and Social Responsibility Society, and Adopted by CIM Council on September 8, 2023. Available at: https://mrmr.cim.org/media/1169/cim-esg-guidelines-for-mineral-resource-and-mineral-reserve-estimation.pdf (Accessed December 17, 2023).

Coombes, J. (2013). Practice Based Competency Development: A Study of Resource Geologists and the JORC Code System. Joondalup, Australia: Edith Cowan University. Available at: https://ro.ecu.edu.au/theses/610 (Accessed December 14, 2023).

CRIRSCO (2019). International Reporting Template for the Public Reporting of Exploration Targets, Exploration Results, Mineral Resources and Mineral Reserves. Available at: https://www.crirsco.com/docs/CRIRSCO_International_Reporting_Template_November_2019.pdf (Accessed January 25, 2024).

ETC (2023). Material and Resource Requirements for the Energy Transition. Report published by the Energy Transitions Commission, version 1, July 2023, 130pp. Available from: https://www.energy-transitions.org/wp-content/uploads/2023/08/ETC-Materials-Report_highres-1.pdf (Accessed December 14, 2023).

European Commission (2020). Critical Raw Materials Resilience: Charting a Path Towards Greater Security and Sustainability. COM(2020) 474 Final. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52020DC0474 (Accessed December 17, 2023).

European Commission (2023). Proposal for a Regulation of the European Parliament and of the Council Establishing a Framework for Ensuring a Secure and Sustainable Supply of Critical Raw Materials and Amending Regulations (EU) No 168/2013, (EU) 2018/858, (EU) 2018/1724. Amended Text as at 14-Sep-2023. Available at: https://www.europarl.europa.eu/doceo/document/TA-9-2023-0325_EN.pdf (Accessed December 14, 2023).

Fernández-Fuentes, I., Correia, V., and Neumann, M. (2021). The Importance of Professional Regulation of Geoscientists and Their Role in a Fast-Changing World. Geol. Soc. Lond. Spec. Publ. 508 (1), 125–135. doi:10.1144/sp508-2020-26

Henley, S., and Allington, R. (2013). PERC, CRIRSCO, and UNFC: Minerals Reporting Standards and Classifications. Eur. Geol. 36, 49–54.

Hoover, H. C. (1909). Principles of Mining: Valuation, Organisation and Administration. New York: McGraw Hill Book Company.

Hoover, H. C. (1951). The Memoirs of Herbert Hoover: Years of Adventure 1874-1920. New York: MacMillan Company.

ICMM (2022). Mining Principles. Available at: https://www.icmm.com/website/publications/pdfs/mining-principles/mining-principles.pdf (Accessed December 14, 2023).

IEA (2022). The Role of Critical World Energy Outlook Special Report Minerals in Clean Energy Transitions. report by the International Energy Authority, originally published May 2021, revised March 2022. Available at: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions (Accessed December 14, 2023).

IFRS (2021). Materiality in IFRS Standards and Financial Reporting. Online article available at: https://ifrscommunity.com/knowledge-base/materiality/ (Accessed December 14, 2023).

IMM (1902). Appendix: Ore in Sight. Transactions of the Institution of Mining and Metallurgy. Vol.X, 202. London: Institution of Mining and Metallurgy.

IRENA (2023). Geopolitics of the Energy Transition: Critical Minerals. Abu Dhabi: International Renewable Energy Agency. report issued in July 2023, Available at: https://www.irena.org/Publications/2023/Jul/Geopolitics-of-the-Energy-Transition-Critical-Materials (Accessed December 17, 2023).

JORC (1972). Report by Joint Committee on Ore Reserves. Australasian Institution of Mining and Metallurgy. Supplement to the AusIMM Bulletin 355. Victoria, Australia: The Australian Institute of Mining and Metallurgy.

JORC (1989). Australasian Code for the Reporting of Identified Mineral Resources and Ore Reserves. Report of the Joint Committee of the Australasian Institution of Mining and Metallurgy and the Australasian Mining Industry Council. Victoria, Australia: The Australian Institute of Mining and Metallurgy.

Kendall, J. D. (1901). Ore in Sight. (Plus Subsequent Discussion). Trans. Institution Min. Metallurgy X, 101–201.

Krzemień, A., Fernández, P. R., Sánchez, A. S., and Álvarez, I. D. (2016). Beyond the Pan-European Standard for Reporting of Exploration Results, Mineral Resources and Reserves. Resour. Policy 49, 81–91. doi:10.1016/j.resourpol.2016.04.008

Minerals Education Coalition (2021). 2021 MEC Mineral Baby. Available at: https://mineralseducationcoalition.org/wp-content/uploads/MECMB21pdf.pdf (Accessed December 14, 2023).

PERC (2021a) The Pan-European Standard for Reporting of Exploration Results, Mineral Resources and Mineral Reserves (The PERC Reporting Standard 2021), Available at: https://percstandard.org/wp-content/uploads/2021/09/PERC_REPORTING_STANDARD_2021_RELEASE_01Oct21_full.pdf (Accessed December 14, 2023).

PERC (2021b). PERC 2021 Definitions Summary Sheet. Available at: https://percstandard.org/wp-content/uploads/2022/05/PERC_2021_DEFINITIONS_EN_English_RELEASE_01Oct21.pdf (Accessed December 17, 2023).

PERC (2022). PERC Summary Guide to Public Reporting for Mineral Companies in Europe. Available at: https://percstandard.org/wp-content/uploads/2023/01/PERC_summary_guide_230115.pdf (Accessed December 14, 2023).

SAMESG (2017). The South African Guideline for the Reporting of Environmental, Social and Governance Parameters Within the Solid Minerals and Oil and Gas Industries (The SAMESG Guideline, 2017). Prepared by the South African Environmental, Social and Governance Committee (SAMESG) Committee. Available at: https://www.samcode.co.za/samcode-ssc/samesg (Accessed December 14, 2023).

SEC (2018). Modernization of Property Disclosures for Mining Registrants: A Small Entity Compliance Guide. Available at: https://www.sec.gov/corpfin/secg-modernization-property-disclosures-mining-registrants (Accessed December 17, 2023).

Segal, T. (2020). What Is Disclosure? How It Works and Laws on Transparency. Online article Available at: https://www.investopedia.com/terms/d/disclosure.asp (Accessed December 14, 2023).

Sides, E. J. (2021). Consideration of ESG Disclosure on Mining Properties. Online article Available at: https://news.thedigbee.com/consideration-of-esg-disclosure-on-mining-properties/ (Accessed December 14, 2023).

SPE (2018). Petroleum Resources Management System. Revised June 2018. Published by the Society of Petroleum Engineers. Available at: https://www.spe.org/en/industry/reserves/ (Accessed December 14, 2023).